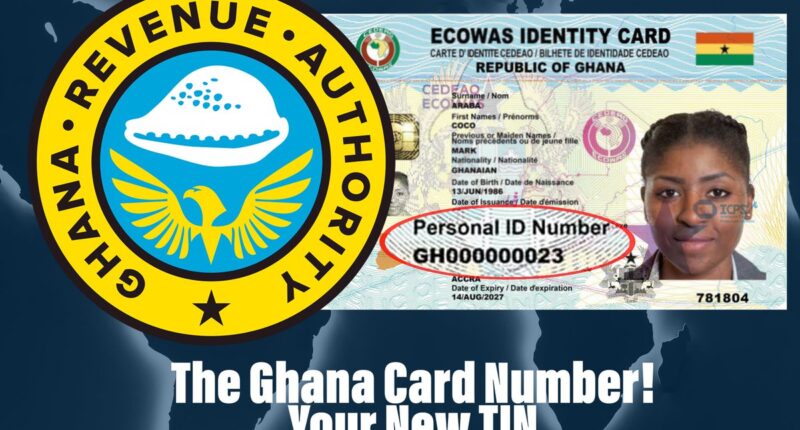

Effective April 1, 2021, the Ghana card Personal Identification Number (Ghana card PIN) will replace the Taxpayer Identification Number (TIN) of individuals issued by the Ghana Revenue Authority for tax identification purposes.

The GRA and the Registrar-Generals Department (RGD) in collaboration with the National Identification Authority, said the change was in line with Government’s policy on the use of a unique identifier for all transactions, where the identification of an individual was required.

In a joint statement issued in Accra, the three Government agencies said to ensure a seamless roll-out of the initiative, some measures had been put in place.

Thy said the measures included; the stationing of Registration Officials of the National Identification Authority (NIA)at 14 GRA offices across the country to register individuals, who were without Ghana cards.

The statement said the Registration Officials would be at the following GRA/RGD offices: TIN Centre, Registrar-Generals Department, Accra, TIN Centre, Customs Long Room, Tema Taxpayer Service Centre, Spintex Road, Taxpayer Service Centre, Adabraka, Taxpayer Service Centre 1, Tema and Taxpayer Service Centre, Koforidua.

The rest are: Taxpayer Service Centre, Cape Coast, Taxpayer Service Centre, Takoradi, Taxpayer Service Centre, Asokwa, Taxpayer Service Centre, Sunyani, Taxpayer Service Centre, Ho Taxpayer Service Centre, Bolgatanga and Taxpayer Service Centre, Wa.

The statement said Registration Officials of the NIA would eventually be stationed at 63 other GRA locations to serve all taxpayers.

It said there would be a transition period from April 1, 2021 to December 31, 2021, where both the TIN and Ghana Card PIN may be used simultaneously as the unique number for tax identification purposes.

After that period, it was expected that all existing TINs would be replaced with the Ghana Card PIN, it said.

The statement said a Self-Service portal had been made available on the GRA website (www.gra.gov.gh) for existing taxpayers, who had registered and had been issued with Ghana card to link their Ghana card PIN to their TIN.

“Any taxpayer with a Ghana card must present it at any GRA office to be registered as a taxpayer,” it said.

It said it must be noted that, for transactions such as the filing of returns, payment of taxes, clearing of goods, registering of businesses, the Ghana card PIN should be quoted on the documentation (Application Forms, Returns and Schedules) supporting the transactions.

Source:GNA