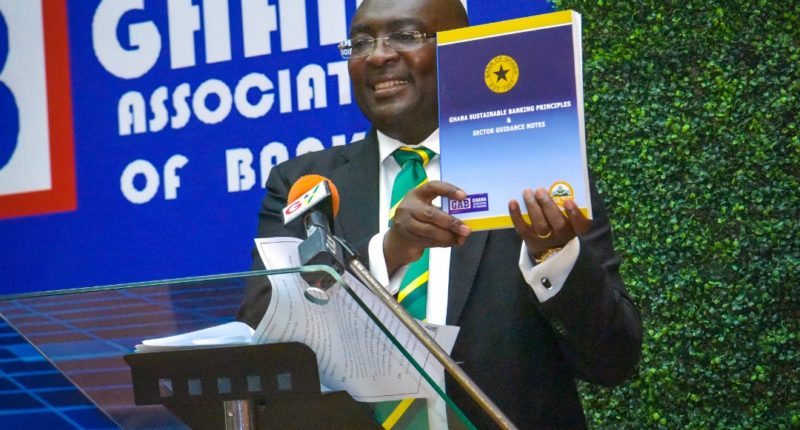

The Vice President, Dr Mahamudu Bawumia, has launched Ghana’s Sustainable Banking Principles and Sector Guidance Notes.

They consist of seven (7) general Principles and five (5) Sector Specific Guidance Notes and present sustainable banking as a two-way interrelated imperative aimed at improving the contribution of finance to sustainable and inclusive growth by funding society’s long term needs; and strengthening financial stability by incorporating environmental, social and governance (ESG) factors in lending decision-making.

The five Sector-specific Guidance Notes on priority areas of the economy cover the Agriculture & Forestry, Mining and Oil & Gas, Construction and Real Estate, Power and Energy, and Manufacturing activities as related to the banking portfolios.

The Principles are to assist banks to respond to the emerging global megatrend issues, such as human security, anti-money laundering, socially responsible stewardship, information communication transparency and disclosure, corporate integrity, environmental and climate change.

They will initially be applied to universal banks and subsequently broadened to include rural banks, savings and loans institutions, microfinance institutions and all the categories of non-bank financial institutions.

Launching the Principles and Notes in Accra on Wednesday, 27th November 2019, Vice President Bawumia emphasised that Ghana’s banking sector needed to be in step with the rest of the world in addressing the challenges arising from climate change.

“Financial institutions must include climate disruption issues or inclement weather into their risk management and reporting. It is becoming more and more imperative for sustainability issues to be incorporated into the responsibilities and reporting of market actors to guide their decision making.

“There is no doubt that environmental risk – and risk arising from climate change in particular – constitutes a significant systemic risk for the financial sector. Such fundamental changes in the environment could affect economic and financial stability and the safety and soundness of financial firms, with clear potential implications for central banks.

“In this context, the Government of Ghana announced that it will implement measures to undertake climate change and green economy programmes and projects, which will promote a clean environment, increase job creation and accelerate poverty reduction.

“These focus areas are in line with SDG2 for Zero Hunger, SDG3 for Good Health and Well-being, SDG5 for Gender Equality, SDG6 for Clean Water and Sanitation, and SDG7 for Affordable and Clean Energy.”

Already, Ghana has introduced climate risk management in agriculture by setting up the Ghana Incentive Based Risk Sharing System for Agricultural Lending, he added.

Vice President Bawumia lauded key stakeholders in Ghana’s financial sector for putting together such a key document to guide the nation’s banking and finance sector.

“This document is a very comprehensive one, providing guidance for the use and applicability of the Principles. Inherent risks and opportunities in the relevant applicable sectors have also been comprehensively drawn up. It is heart-warming that it is the Central Bank, the Bank of Ghana which has spearheaded this great transition into introducing sustainability in our banking practices.

“I’m glad to note too that while reflecting our peculiar Ghanaian circumstances, they have been aligned to international best practice. I say a big Ayekoo to the three collaborating institutions, Bank of Ghana, Ghana Association of Banks and the Environmental Protection Agency.”

The President of the Ghana Association of Banks, Mr Alhassan Andani, assured that having been part of the crafting process, “we (banks) pledge our commitment to the full implementation of these guidelines.”